Navan Inc. — the name that’s shaking up corporate travel and expense management. Once known as TripActions, this Silicon Valley giant is redefining how businesses book, manage, and control travel costs with smart AI-powered tools. Backed by top investors and trusted by global brands, Navan is stepping onto Wall Street with a $6.45 billion IPO. From booking flights to tracking every dollar spent, Navan promises speed, savings, and innovation — but the real question is, can it turn this hype into long-term profits?

What NAVAN exactly is ?

Navan is your all-in-one travel and expense buddy for business. Book flights, find great hotels, manage payments, and track expenses — all in one smooth platform. With 24/7 support and smart automation, Navan makes business travel simple, stress-free, and surprisingly easy to love.

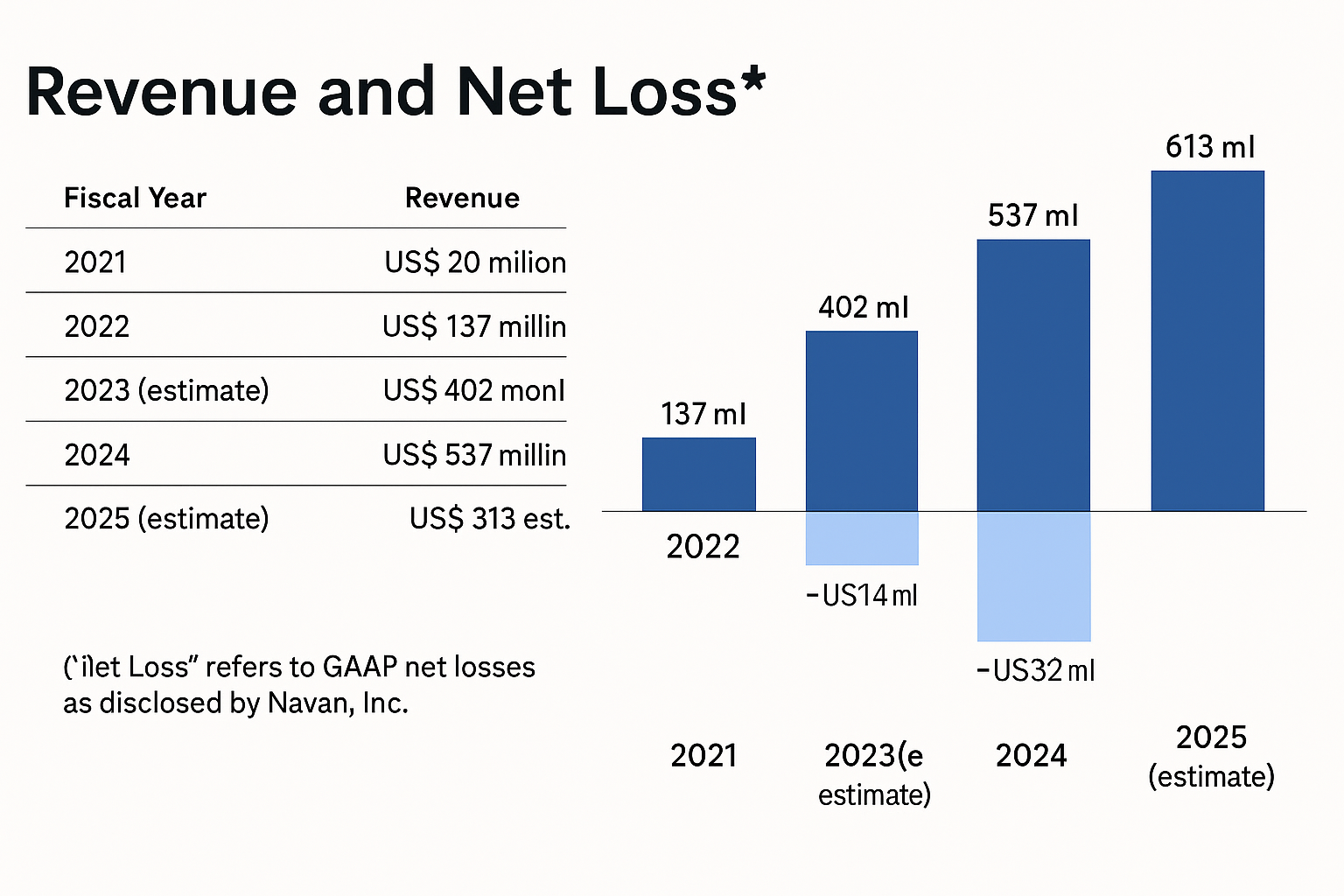

The company has raised a total of about $2.2 billion in funding to date and serves over 10,000 customers globally. Although Navan has yet to become profitable, it is narrowing losses and improving margins, with its 2024 revenue climbing to $537 million and net losses decreasing compared to previous years.

Navan was founded in 2015 by Ariel Cohen and Ilan Twig. Cohen is the CEO, and Twig is the Chief Navan is planning to sell 36.9 million shares of its Class A stock to the public for the first time.

Back in February 2022, TripActions — now known as Navan — expanded its global footprint by purchasing Comtravo, a Berlin-based travel tech firm with 2,500 business clients and 250 staff members.

Navan Company Revenue Breakdown (2019-2024)

NAVAN has narrowed its operating losses significantly, mainly due to its use of AI driven automation in customer support and operations, including AI assistant called Ava that handles half of use queries.

Just summarize about NAVAN IPO

At Nasdaq Global select market, Ticker symbol – NAVN, Share price range $24-26, valuation estimation 6.5 billion dollar, capital raised $ 960 million, Underwriters – Goldman Sachs, Citi, Jefferies, Morgan Stanley, Mizuho and others.

Much of the IPO proceeds will be used to reduce debt roughly $657 million in total obligations, including convertible bonds and a SAFE notes.

Navan is planning to sell 36.9 million shares of its Class A stock to the public for the first time.

Out of these:

- 30 million shares will be sold by Navan itself (the company will get this money).

- 6.9 million shares will be sold by existing investors (they will get that money, not the company).

The company expects each share to cost between $24 and $26.

At that price, Navan could raise up to about $960 million and be worth around $6.5 billion after the IPO.

After Navan’s IPO, the company’s two co-founders will still control most of the voting power.

- Ariel Cohen (CEO) will own or control about 24% of the company’s voting shares.

- Ilan Twig (CTO) will own or control about 43%.

Together, they’ll keep majority control of Navan, meaning they’ll have the biggest say in company decisions even after new investors buy shares.

Surprising Drop in Navan’s Value!

Just three years ago, in October 2022, Navan — then known as TripActions — was flying high with a massive $9.2 billion valuation after raising $304 million in funding. But fast forward to 2025, its upcoming IPO is expected to value the company at around $6.45 billion — a sharp decline that’s turning heads across the tech world.

WHAT CAN WE EXPECT TO DO FOR THIS IPO ?

Navan Inc. is a leading company in its industry, showing strong and consistent growth. Its revenue has been rising by about 30% every year, and while the company is still reporting losses, those losses have significantly decreased year after year. In the first half of 2025, Navan’s revenue reached an impressive $313 million (about $329 million according to filings) — proving its strong business momentum despite ongoing investments in growth.

avan Inc. stands out as a fundamentally strong company with steady performance. Its financial foundation looks solid — revenue is growing by around 30% every year, and losses have sharply declined over time. Given its consistent growth, improving efficiency, and expanding market position, this could turn out to be one of the best stocks to own for the future.

This information is for educational purposes only and is not financial advice. Please do your own research or consult a financial advisor before making any investment decisions.