When Bank of America Chairman and CEO Brian Moynihan spoke with Margaret Brennan on “Face the Nation,” the message sounded simple, but it carried weight. Many Americans say they feel squeezed, especially during the holidays, because prices still feel high. However, Moynihan said Bank of America’s real transaction data shows something different. People keep spending, and they do it at a steady pace as the year ends. That gap between feelings and behavior is now one of the most important stories in the U.S. economy.

Holiday Spending Looks Strong in the Data

Brennan pointed to polling that shows many Americans say holiday items feel hard to afford. She also said people believe incomes are not keeping up with inflation. Moynihan did not dismiss that feeling, but he added context from what his bank can see. Bank of America tracks spending across millions of customers, so it sees what people do, not just what they say.

He explained that spending through the Thanksgiving weekend, including Black Friday and Cyber Monday, rose by a little over four percent compared with last year’s November. He said the growth continued across November and into early December, which suggests consumers did not suddenly freeze. That matters because the holiday season often reveals how confident people feel about their finances, even when they complain about prices.

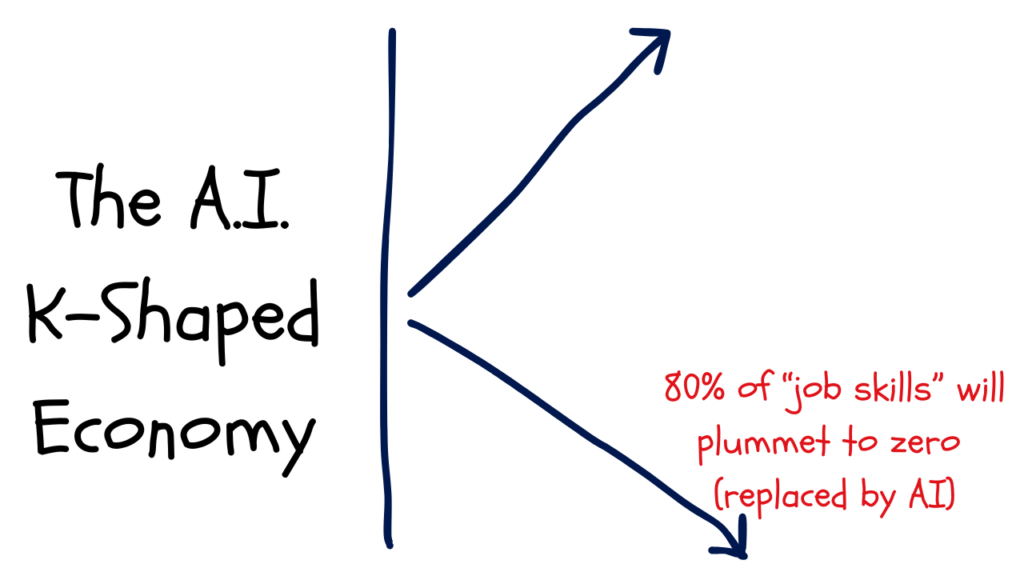

Is It a K-Shaped Economy or Something More Mixed?

Brennan asked a direct question that many Americans debate: does spending mainly come from higher-income households, creating that “K-shaped” economy where some groups do well while others struggle? Moynihan said the growth rate differs by income group, but all three income buckets still show growth. In other words, higher-income groups spend more and often grow faster, but lower-income groups also spend more than last year. That does not erase stress at the bottom, but it does show a broader base of activity than many people expect.

He also said this pattern has stayed consistent. That point matters because it suggests the economy did not change overnight. Instead, it continues along a path where consumption remains “reasonably solid,” even while people talk about how expensive life feels.

Why Sentiment Feels Low While Spending Stays Up

Brennan then asked the key question: why do people report low confidence but still spend more? Moynihan pointed to the unusual path the country traveled from 2020 onward. The U.S. went from COVID lockdowns to massive stimulus, and then inflation rose sharply. After that, wages started to catch up, but people already felt the damage from higher prices.

He explained it like a timeline problem. Wages, prices, and spending usually move in sync over long periods, but inflation hit at a different time and with a different speed. People saw prices jump in 2020 through the following years, so those memories still shape how they think today. Even if inflation eases now, it takes time for people to feel relief. That is why Americans can feel unhappy while still acting like they believe their finances can handle purchases.

At the same time, Moynihan acknowledged real pressure points. Inflation still bothers people, and unemployment has risen slightly even though it remains low by historical standards. He mentioned that some job categories face more disruption, partly because of government downsizing and other shifts. Still, he emphasized that people remain employed, credit quality looks good, and wages continue to rise as paychecks come in. So the consumer engine still runs, even with loud complaints.

The Biggest Risk: Will the Consumer Keep Going?

When Brennan asked about the biggest risk to the economy, Moynihan gave a clear answer. He said the core risk is not a mystery financial product or a sudden banking shock. The main risk is whether the American consumer keeps spending into 2026. Bank of America expects around 2.4% growth next year, but that forecast depends on consumers staying engaged. If households cut spending, the economy slows. Moynihan said he does not see that pullback right now, but he still treats it as the main thing to watch.

He also named other risks that could hit quickly. Wars can shake markets, and cyber events can create sudden disruption. Those risks exist in the background, and they can change sentiment fast. Still, his base view stays steady as long as companies keep hiring and paying workers.

When asked if he has any concerns of political interference with the Federal Reserve once President Trump selects its next chairman, Bank of America CEO Brian Moynihan says: “The market will punish people if we don't have an independent Fed. And everybody knows that.”

— Face The Nation (@FaceTheNation) December 28, 2025

Moynihan… pic.twitter.com/2gvzn9RdoB

Trade and Tariffs: From Shock to Something More Predictable

Brennan raised trade and tariffs, because earlier shocks created uncertainty for businesses. Moynihan said that in the spring, many companies, especially small and medium-sized businesses, faced real confusion. They did not know where tariff policy would end up, so they struggled to commit to orders or set prices.

However, he said the situation has started to look more defined over time. He described a world where many countries settle into a broadly manageable tariff level, while China remains a different case because of national security issues like rare earth minerals, magnets, batteries, and AI-linked supply chains. He also noted that the U.S.-Mexico-Canada agreement adds another layer of complexity. Still, his larger point was that businesses can plan better when policy moves from shock to clearer end points.

Small Businesses Now Worry More About Labor Than Tariffs

Moynihan then explained what small businesses tell Bank of America today. Earlier in the year, higher rates hurt them because many borrow on floating-rate credit lines. Tariff uncertainty also made it harder to commit to inventory decisions. Later, as rates eased a bit and trade became less confusing, another issue moved to the front: labor.

He said many small businesses now ask the same question: can I find the people I need to do the work? They want clear immigration rules because uncertainty makes workers feel less stable, and that hurts reliability for employers. Moynihan stressed that small businesses do not ask for endless debate. They ask for rules they can follow, because they need dependable staffing to bid contracts and deliver services.

AI in Banking: Useful, But Trust Comes First

Brennan asked about artificial intelligence and jobs. Moynihan said consumers already experience AI through Bank of America’s digital assistant, which handles millions of interactions each day and answers hundreds of questions. He also said banks have used predictive models for years, including stress testing and default prediction. AI can improve speed and help employees work smarter, but banks must apply it carefully when customers depend on accurate answers.

On the job question, Moynihan argued that efficiency does not automatically mean layoffs. He compared the AI moment to past technology waves and noted that the U.S. still grew employment over decades of innovation. He also said Bank of America continues to hire new college graduates. His message to young workers sounded practical: learn the tools, use them well, and do not let fear control your choices.

Read Also —– https://dollarfeverr.com/how-big-banks-turned-credit-cards-into-americas-default-lifeline/

And lastly Feelings Stay Heavy, But the Economy Still Moves

This interview showed a realistic picture of America right now. People feel inflation in everyday life, so they report low confidence. However, spending data shows continued activity, and strong employment supports that behavior. Moynihan sees risks, especially if consumers pull back, and he also watches global shocks like war and cyber threats. Still, he believes the U.S. economy stays on a solid path if jobs and wages keep flowing. For now, Americans may complain loudly, but they still participate in the economy with their actions.